One area that has not been reviewed in developing countries is the growing focus on different segments of the taxpayer population including the large taxpayers as a way to encourage greater stability in public revenue flows improve the effectiveness and efficiency of tax administration and introduce innovations in the public sector. Many large taxpayers that have experienced the discussions held with their respective hmrc crms as being productive and provide hmrc with useful and relevant taxpayer specific information which can be used effectively efficiently and appropriately for tax.

Taxing Cannabis Itep

Taxpayer compliance developing countries.

[Free DOWNLOAD] Improving Large Taxpayers Compliance A Review Of Country Experience. Improving the large taxpayer office organization 4. One area that has not been reviewed in developing countries is the growing focus on different segments of the taxpayer population including large taxpayers as a way to encourage greater stability in public revenue flows. One area that has not been reviewed in developing countries is the growing focus on different segments of the taxpayer population including the large taxpayers as a way to encourage greater stability in public revenue flows improve the effectiveness and efficiency of tax administration and introduce innovations in the public sector.

Fiscal administration large taxpayer office a. Tax administration and procedure developing countries. Clearly the experience of many developing and transition countries shows that setting up special operations to control large taxpayer compliance has resulted in increased compliance and more effective tax administration overall.

Free shipping on qualifying offers. Issues and the degree of non compliance by large taxpayers. Despite reorganization the ltos ability to implement modern risk based methods continues to be impeded by its organizational structure.

However all participating countries cite tax compliance issues related to international transactions and international business structures as major areas of concern and focus. While the lto changed to an. A focus on building a better relationship between the tax administration and the large taxpayers is.

Compliance issues may vary from one country to another. Tax administration and procedure. Improving large taxpayers compliance.

Tap News

Oda For Domestic Revenue Mobilisation Development Initiatives

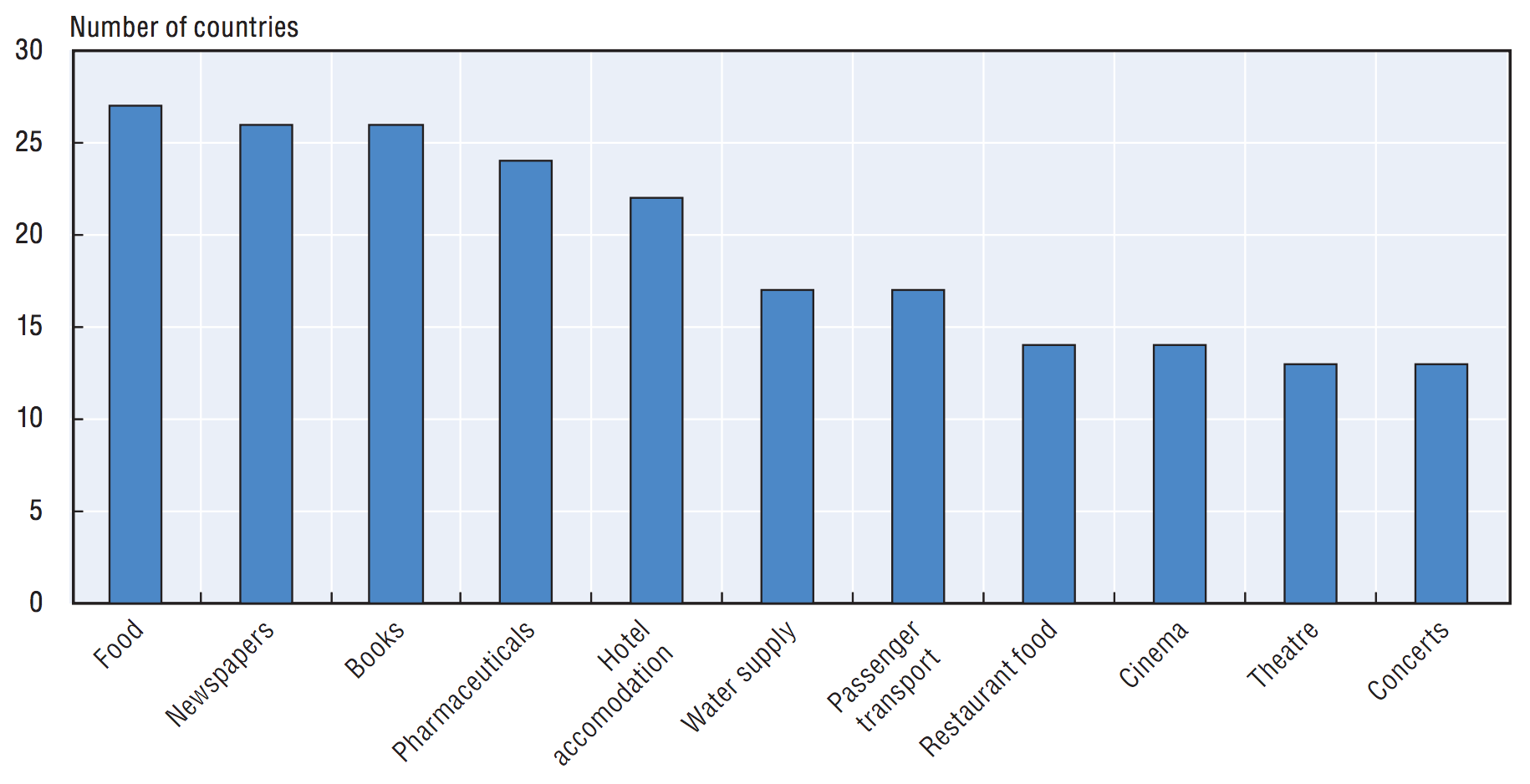

Value Added Tax Wikipedia

Uganda The International Centre For Tax And Development Ictd

Uganda The International Centre For Tax And Development Ictd

Taxation Our World In Data

Taxation Our World In Data

Amazoncom Improving Large Taxpayers Compliance A Review

Amazoncom Improving Large Taxpayers Compliance A Review

Detail

Detail

Factors Influencing Taxpayers Voluntary Compliance Attitude

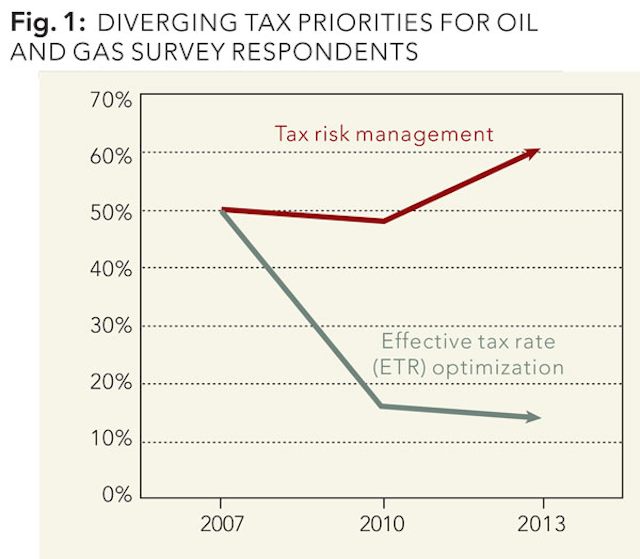

The Challenges Of Transfer Pricing Oil Gas Journal

The Challenges Of Transfer Pricing Oil Gas Journal

Tax Policy Effectiveness And Transparency Inter Agency

Tax Policy Effectiveness And Transparency Inter Agency

Enhancing Voluntary Compliance By Reducing Compliance Costs

Taxation Our World In Data

Tax Compliance In A Developing Country Understanding

The Data Intelligent Tax Administration

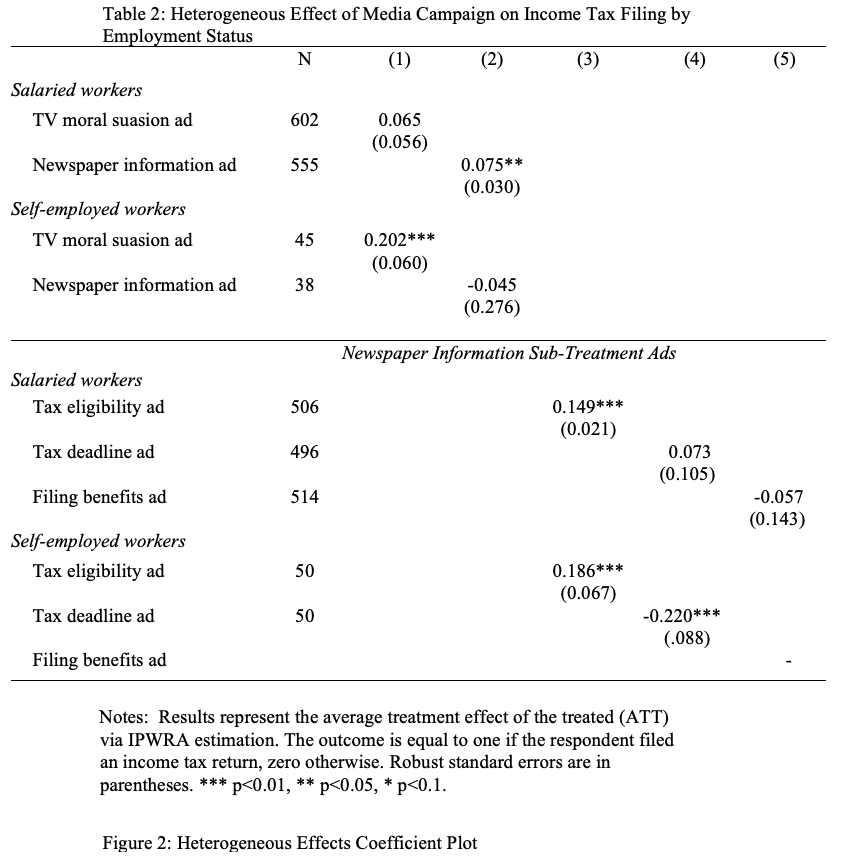

Can Adverts Persuade Citizens To File Their Taxes In

Can Adverts Persuade Citizens To File Their Taxes In

![Download [pdf] Lust Circus Pdf Ebook Download [pdf] Lust Circus Pdf Ebook](http://2.bp.blogspot.com/-fHNpASK1nbg/TpyKb8L1ZEI/AAAAAAAAAwc/qrRLWoguCss/s72-c/lustforlife3.jpg)